Arbitrage and Energy Infrastructure – Part 2

/In the context of electricity, arbitrage plays an important role in the efficient functioning of energy markets. Electricity markets are complex, with diverse sources of generation, varying demand patterns, and geographically dispersed regions. These factors create opportunities for price differentials, making electricity arbitrage an important strategy.

Electricity arbitrage involves capitalizing on discrepancies in electricity prices across different locations or time periods. For example, there may be differences in electricity prices between regions due to variations in supply and demand or transmission constraints. By buying electricity at a lower price in one region and selling it at a higher price in another, arbitrageurs help balance supply and demand, reduce price disparities, and enhance market efficiency.

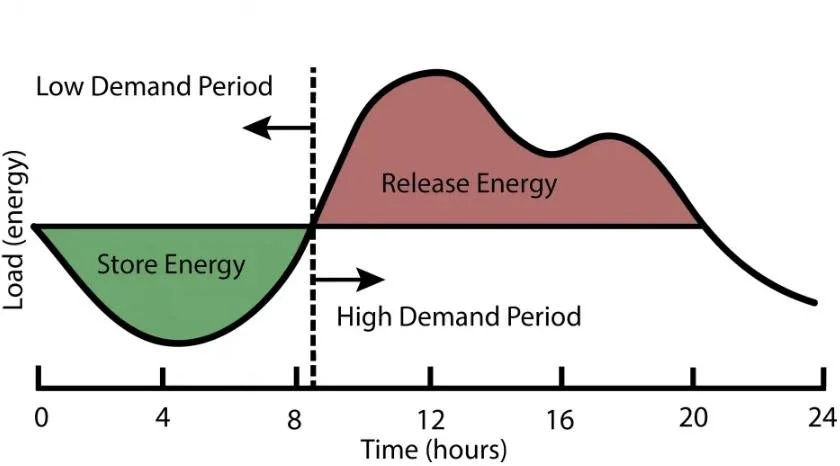

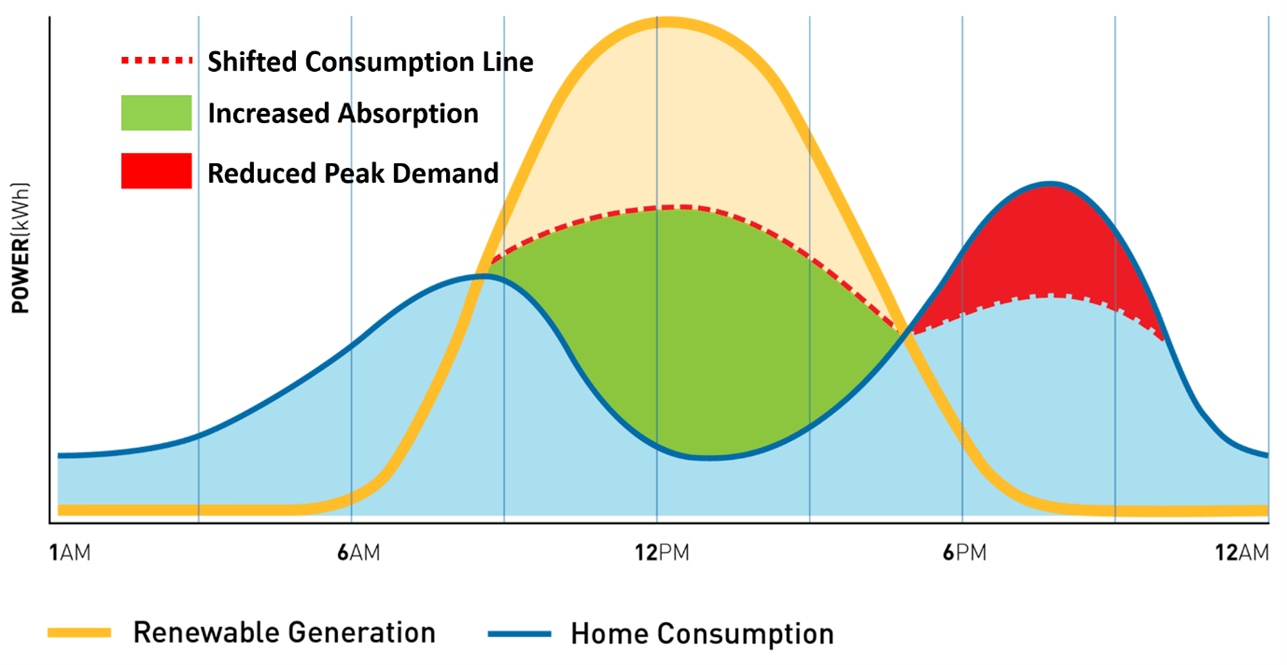

Similarly, arbitrage can occur based on temporal differences in electricity prices. Time-of-use pricing, demand response programs, and dynamic pricing mechanisms result in fluctuating electricity prices throughout the day. Arbitrageurs can take advantage of these price differentials by buying electricity during low-demand or off-peak hours when prices are lower and selling it during high-demand or peak hours when prices are higher.

Yes, traders and arbitrageurs profit from this. But electricity arbitrage provides several benefits to energy markets.

First, it contributes to price convergence, ensuring that electricity prices move towards consistency across different locations and time periods. This encourages fair competition, reduces market inefficiencies, and enhances price discovery.

Second, arbitrage helps to optimize the development and utilization of generation, transmission, and storage infrastructure. By moving electricity from areas of surplus to areas of deficit, it helps balance supply and demand, mitigating congestion and maximizing resource utilization.

Furthermore, electricity arbitrage supports grid stability and reliability. By participating in ancillary services markets, such as frequency regulation and load balancing, arbitrageurs can provide flexibility to the grid, helping to maintain system stability. They can also play a role in managing intermittency issues associated with renewable energy sources by storing excess energy during periods of low demand and releasing it during high-demand periods.

The bottom line? The provision of massive amounts of electricity is not really possible without arbitrageurs doing what they do.